Counseling firms generally charge a cost for their services, often around $125. This fee can be paid from the loan proceeds, and you can not be turned away if you can't pay for the charge. With a HECM, there usually is no particular income requirement. However, lending institutions should carry out a financial evaluation when choosing whether to approve and close your loan.

Based on the outcomes, the lender might require funds to be set aside from the loan proceeds to pay things like real estate tax, homeowner's insurance coverage, and flood insurance (if applicable). If this is not needed, you still might agree that your loan provider will pay these products. If you have a "set-aside" or you agree to have the loan provider make these payments, those amounts will be subtracted from the quantity you get in loan profits.

The HECM lets you pick among a number of payment choices: a single disbursement alternative this is only offered with a set rate loan, and generally uses less cash than other HECM options. a "term" choice repaired regular monthly money advances for a specific time. a "period" choice fixed monthly cash advances for as long as you reside in your house.

This option restricts the quantity of interest troubled your loan, since you owe interest on the credit that you are utilizing. a combination of regular monthly payments and a credit line. You might be able to change your payment alternative for a little charge. HECMs typically offer you larger loan advances at a lower total cost than proprietary loans do.

Some Known Details About How Do Reverse Mortgages Work After Death

Taxes and insurance still must be paid on the loan, and your house must be kept. With HECMs, there is a limitation on how much you can take out the very first year. Your lending institution will calculate just how much you can obtain, based on your age, the rates of interest, the value of your house, and your financial assessment.

There are exceptions, though. If you're considering a reverse mortgage, search. Choose which type of reverse mortgage may be right for you. That might depend on what you wish to make with the cash. Compare the choices, terms, and charges from various lenders. Discover as much as you can about reverse home mortgages prior to you talk with a Check out this site therapist or lending institution.

Here are some things to consider: If so, learn if you get approved for any affordable single purpose loans in your area. Staff at your city Firm on Aging might learn about the programs http://raymondpthi774.almoheet-travel.com/the-which-type-of-interest-is-calculated-on-home-mortgages-ideas in your area. Find the closest firm on aging at eldercare.gov, or call 1-800-677-1116. Ask about "loan or grant programs for home repairs or enhancements," or "property tax deferral" or "real estate tax postponement" programs, and how to apply.

But the more you obtain, the greater the fees you'll pay. You also may think about a HECM loan. A HECM therapist or a lender can assist you compare these kinds of loans side by side, to see what you'll get and what it costs. This bears duplicating: search and compare the expenses of the loans available to you.

Getting My How Do 2nd Mortgages Work? To Work

Ask a therapist or lending institution to describe the Overall Annual Loan Expense (TALC) rates: they show the predicted yearly average cost of a reverse home mortgage, including all the itemized expenses (how do mortgages work). And, no matter what type of reverse home loan you're thinking about, comprehend all the reasons why your loan may need to be paid back prior to you were intending on it.

A therapist from an independent government-approved housing counseling company can assist. However a sales representative isn't most likely to be the very best guide for what works for you. This is particularly true if he or she acts like a reverse home mortgage is a solution for all your problems, pushes you to take out a loan, or has concepts on how you can invest the cash from a reverse home mortgage.

If you decide you require home improvements, and you believe a reverse mortgage is the method to pay for them, search prior to selecting a specific seller. Your house improvement expenses consist of not only the rate of the work being done but also the expenses and costs you'll pay to get the reverse home loan.

Withstand that pressure. If you buy those type of financial products, you might lose the cash you receive from your reverse mortgage. You don't have to buy any financial items, services or financial investment to get a reverse home mortgage. In truth, in some circumstances, it's prohibited to require you to purchase other items to get a reverse home mortgage.

The smart Trick of How Subprime Mortgages Work That Nobody is Discussing

Stop and talk to a therapist or somebody you trust prior to you sign anything. A reverse mortgage can be made complex, and isn't something to rush into. The bottom line: If you do not comprehend the cost or functions of a reverse home mortgage, walk away. If you feel pressure or urgency to complete the offer leave.

With a lot of reverse home mortgages, you have at least 3 business days after closing to cancel the offer for any factor, without penalty. This is known as your right of "rescission." To cancel, you should notify the lending institution in writing. Send your letter by certified mail, and request a return invoice.

Keep copies of your correspondence and any enclosures. After you cancel, the lender has 20 days to return any money you have actually paid for the financing. If you think a rip-off, Find more information or that someone associated with the deal may be breaking the law, let the counselor, lender, or loan servicer know.

Whether a reverse home loan is right for you is a huge concern. Consider all your choices. You might get approved for less pricey alternatives. The following companies have more information: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

The Basic Principles Of How Do Points Work With Mortgages

Merely put, a home mortgage is the loan you get to spend for a home or other piece of genuine estate. Provided the high expenses of purchasing home, nearly every house purchaser requires long-term financing in order to acquire a home. Usually, mortgages come with a set rate and make money off over 15 or thirty years.

Home mortgages are property loans that feature a defined schedule of payment, with the purchased residential or commercial property functioning as security. In many cases, the borrower needs to put down in between 3% and 20% of the overall purchase cost for your home. The remainder is offered as a loan with a fixed or variable rate of interest, depending upon the type of home loan.

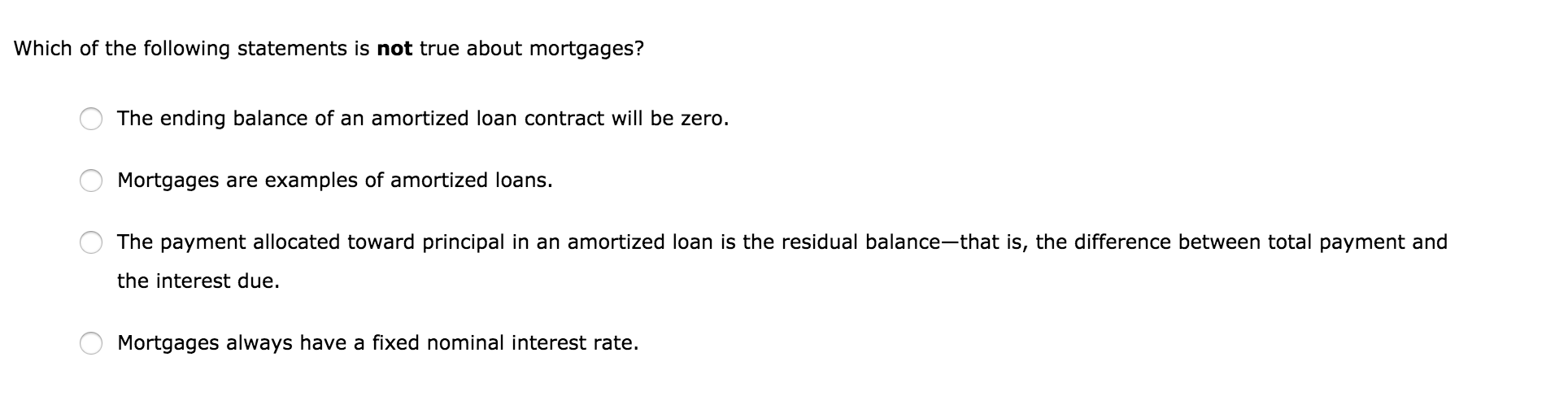

The size of the deposit might also impact the quantity required in closing costs and month-to-month home loan insurance coverage payments. In a process called amortization, the majority of mortgage payments are split in between paying off interest and lowering the primary balance. The percentage of primary versus interest being paid each month is calculated so that principal reaches absolutely no after the final payment.

A few mortgages enable interest-only payments or payments that don't even cover the full interest. Nevertheless, individuals who plan to own their homes must choose for an amortized home mortgage. When you purchase a home, understanding the common types of home loans and how they work is simply as essential as finding the best house.